Every year, the Internal Revenue Service (IRS) unveils new tax brackets, which represent different tiers of income taxed at various rates within the United States’ progressive tax system. This system ensures that individuals with higher incomes pay higher tax rates. The tax brackets for 2023, affecting tax returns filed in 2024, have been adjusted slightly upward to account for inflation.

Tax brackets function based on the concept of progressive taxation, where each tier of income incurs a progressively higher tax rate. The lowest tax rate is applied to the lowest income tier, with subsequent tiers incurring slightly higher rates. The highest tax rate applies only to the highest income tier reached by an individual.

The IRS adjusts tax brackets annually to accommodate inflation, ensuring that the brackets remain in line with the changing economic landscape. If an individual’s income rises with inflation, they may face a similar tax rate as the previous year. However, a faster-than-inflation salary increase could push someone into a higher tax bracket, while stagnant wages might keep them in a lower bracket.

As of 2023, the U.S. tax system comprises seven tax brackets, each corresponding to a specific income range. The highest individual tax bracket is 37%, applying to incomes beyond $578,125 for single individuals. For married couples filing jointly, the top rate kicks in at $693,750, while for married individuals filing separately, it begins at $346,875.

The 2023 tax brackets for individual filers are as follows:

- 37% for incomes over $578,125.

- 35% for incomes over $231,250.

- 32% for incomes over $182,100.

- 24% for incomes over $95,375.

- 22% for incomes over $44,725.

- 12% for incomes over $11,000.

- 10% for income below $11,000.

For married couples filing jointly, the tax brackets are structured as follows:

- 37% for income greater than $693,750.

- 35% for incomes over $462,500.

- 32% for incomes over $364,200.

- 24% for incomes over $190,750.

- 22% for incomes over $89,450.

- 12% for incomes over $22,000.

- 10% for income below $22,000.

Heads of households, typically single parents covering more than half of a household’s expenses, have higher income thresholds for each tax bracket. The head of household tax brackets for 2023 are:

- 37% on the portion of income above $578,100.

- 35% on the portion of income between $231,251 and $578,100.

- 32% on the portion of income between $182,101 and $231,250.

- 24% on the portion of income between $95,351 and $182,100.

- 22% on the portion of income between $59,851 and $95,350.

- 12% on the portion of income between $15,701 and $59,850.

- 10% on income below $15,700.

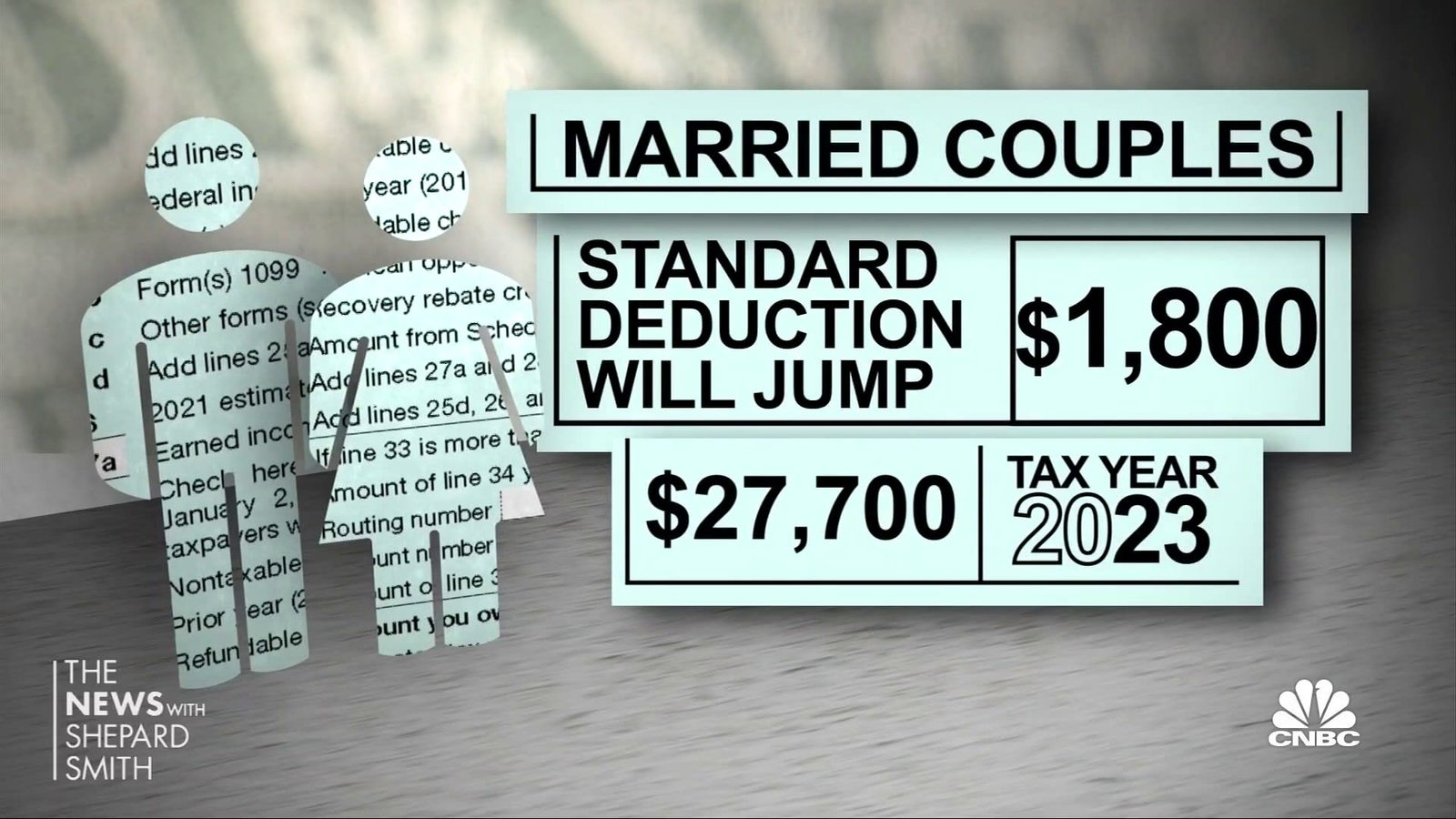

Comparing the tax brackets for 2023 and 2022 reveals that the thresholds increased for each of the seven brackets, indicating a slight adjustment for inflation.

Looking ahead to 2024, the IRS has already released tax brackets for that year. The top individual tax bracket sees an income threshold increase from $578,126 to $609,351. The other 2024 tax brackets for individual filers are:

- 35% for incomes over $243,725.

- 32% for incomes over $191,950.

- 24% for incomes over $100,525.

- 22% for incomes over $47,150.

- 12% for incomes over $11,600.

- 10% for income below $11,600.

For married couples filing joint returns in 2024, the tax brackets are:

- 37% for income greater than $731,200.

- 35% for incomes over $487,450.

- 32% for incomes over $383,900.

- 24% for incomes over $201,050.

- 22% for incomes over $94,300.

- 12% for incomes over $23,200.

- 10% for income below $23,200.

To potentially lower one’s tax bracket, individuals can explore options such as filing joint returns with a spouse, contributing to a 401(k) if available, or contributing to a traditional Individual Retirement Account (IRA) for a tax deduction. Deciding between standard and itemized deductions may also impact the tax bracket based on an individual’s financial circumstances. It’s crucial to assess these strategies and consult with a tax professional for personalized advice.