The prospect of a surge in layoffs and the looming threat of a recession in the wake of a substantial slowdown in inflation has become a subject of consideration. While the notion may initially seem improbable, the easing, albeit still elevated, inflation has provided relief to consumers and prompted Federal Reserve officials to signal a potential reduction in interest rates, with three cuts anticipated in 2024. The resulting impact has seen the stock market reach new highs.

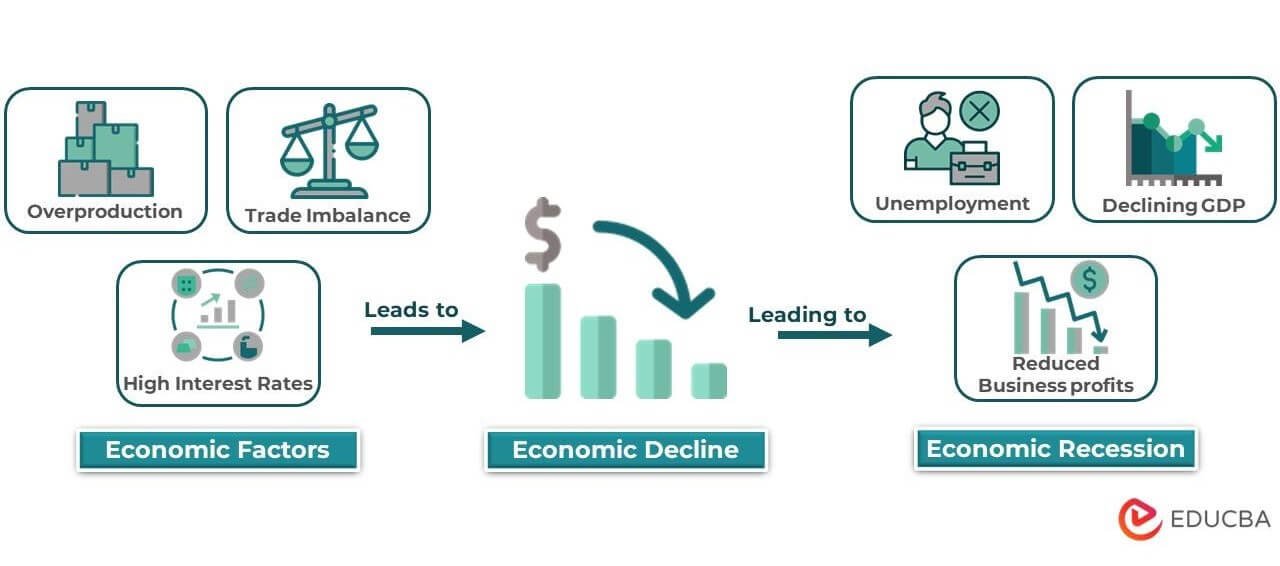

However, economists are raising concerns about the combination of decreasing inflation rates and softened consumer demand, suggesting a potential narrowing of corporate profit margins. This, in turn, could trigger more companies to initiate layoffs, potentially sparking a mild economic downturn.

Kathy Bostjancic, Chief Economist of Nationwide, explains that as inflation declines, so does pricing power, affecting a company’s ability to raise prices without losing customers. The reduction in pricing power, she notes, directly impacts profit margins, a crucial aspect on Wall Street.

In the face of squeezed profit margins, companies are likely to cut expenses, with employment being a significant target, according to Bostjancic. Drawing on data from Nationwide and Bloomberg, she highlights that falling profit margins have historically coincided with a rising unemployment rate in the past four recessions.

Joseph LaVorgna, Chief Economist of SMBC Nikko Securities, emphasizes that compressed margins would be detrimental to both the job market and stocks. While this viewpoint is not universally shared among forecasters, recent signals from corporate earnings have raised concerns over the past year.

Despite the overall resilience of the economy, marked by record highs for the S&P 500 stock index and rebounding consumer sentiment, some economists remain cautious. Notable companies, including Macy’s, Google, Wayfair, Amazon, Citigroup, and Universal Music, have recently announced layoffs, raising concerns that this trend may intensify if corporate bottom lines continue to be strained.

As of now, only 10% of S&P 500 companies have reported fourth-quarter earnings, with estimates suggesting that margins for the entire earnings season will average 10.9%, the lowest since late 2020. While the economy remains on solid footing, economists acknowledge the potential impact of shrinking profit margins on the job market.

The past year witnessed a significant impact on corporate profits due to inflation, with S&P 500 profit margins peaking at 13% in the spring of 2022. However, by late 2022 and 2023, more Americans began resisting outsize price increases, contributing to an earnings recession for S&P 500 companies.

While FactSet anticipates a rebound in margins in the first half of this year, concerns persist that declining sales and rising employee wages may create challenges, particularly for service companies. The average hourly pay grew by 4.1% annually in December, and economist Kathy Bostjancic predicts that consumer spending may soften due to delayed effects of Fed rate hikes, credit card delinquencies, and the depletion of pandemic-related savings.

Bostjancic expects 1.6 million job losses in 2024, potentially pushing the unemployment rate from 3.7% to 4.8%. However, there is a caveat. Strong productivity growth, fueled by technology and other improvements, could potentially allow businesses to continue raising wages without a significant blow to earnings and job cuts.

In conclusion, the intricate interplay between declining inflation, corporate profits, and potential economic repercussions underscores the need for a careful examination of various economic indicators. While some economists remain optimistic about the economy’s resilience, the uncertainty surrounding profit margins and their impact on employment emphasizes the importance of closely monitoring the evolving economic landscape.