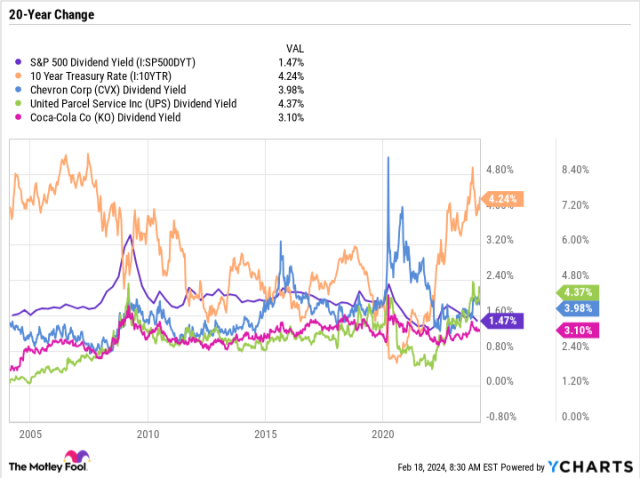

Amid the S&P 500’s surge to record highs, investors may seek alternative avenues for generating passive income. While the index traditionally serves as a source of passive income, its current yield of 1.5% pales in comparison to the 4.2% offered by the risk-free 10-year Treasury rate. This decline in the S&P 500’s yield can be attributed to the outperformance of many top dividend stocks and the increased presence of companies within the index that either offer very low dividends or none at all.

However, there are three dividend stocks—Chevron (NYSE: CVX), United Parcel Service (NYSE: UPS), and Coca-Cola (NYSE: KO)—that boast yields exceeding double that of the S&P 500, making them compelling investment options in the current market landscape.

Chevron, a leading energy company, has recently demonstrated robust performance, marked by an 8% increase in its dividend to a record high following a strong showing in 2023. Additionally, the company executed a record share buyback program last year. Amidst a 17.8% decline from its all-time high, Chevron remains poised for further growth, particularly with favorable oil prices. Despite the current West Texas Intermediate benchmark price of $78 per barrel, which is below the levels seen in 2022, Chevron’s operational efficiency and profitability are expected to drive significant free cash flow. With a balanced balance sheet and potential for upside if oil prices rise, Chevron offers a competitive 4% dividend yield.

United Parcel Service, commonly known as UPS, presents another attractive dividend stock opportunity. Despite experiencing pressure on its stock and profitability due to declining revenue and ongoing investments, UPS has maintained a high dividend yield. Following a 49% dividend increase in early 2022, UPS currently offers a forward yield of 4.4%. While facing challenges in sustaining the surge in package delivery volumes witnessed during the pandemic, UPS remains undervalued considering its improvements over the past four years. Despite potential short-term setbacks, UPS represents a compelling opportunity for patient investors seeking passive income.

Coca-Cola, a renowned beverage company, has been a stalwart dividend payer, with a track record of 62 consecutive annual dividend increases. As a Dividend King—a designation reserved for companies that have raised dividends annually for at least 50 years—Coca-Cola continues to prioritize meaningful dividend raises over maintaining its streak. With a recent 5.4% dividend increase, Coca-Cola demonstrates its commitment to shareholders despite underperforming the market. While not immune to market fluctuations, Coca-Cola’s recession-resistant business model and dependable dividend payments make it an appealing option for risk-averse investors or those in retirement seeking stable passive income.

Chevron, UPS, and Coca-Cola stand out as dividend stocks offering yields that significantly surpass the S&P 500’s current rate. While they may not appeal to investors seeking rapid market gains, these companies present compelling opportunities for long-term wealth accumulation through consistent dividend payouts. By investing in well-established companies with robust dividend policies, investors can mitigate risk and achieve financial stability over time.