Navigating the complexities of tax season can be a challenging task, whether you’re a seasoned filer or a newcomer to the process. Amidst the myriad calculations, one crucial aspect to consider is the capital gains tax – a levy imposed by the government on profits generated from various investments, ranging from stocks to valuable possessions.

Understanding the ins and outs of the capital gains tax, including the rates for 2024 and the distinction between short-term and long-term profits, is essential for anyone looking to fulfill their tax obligations accurately.

Defining Capital Gains Tax

At its core, capital gains refer to the profits earned by selling an asset at a higher price than the purchase price. It’s crucial to note that these gains are subject to taxation only when the asset is sold, realizing the actual profit. For instance, if you bought a stock for $100, and its value increased to $200, the $100 increase is considered a capital gain. However, you’ll only be taxed on this gain when you decide to sell the stock and realize the profit.

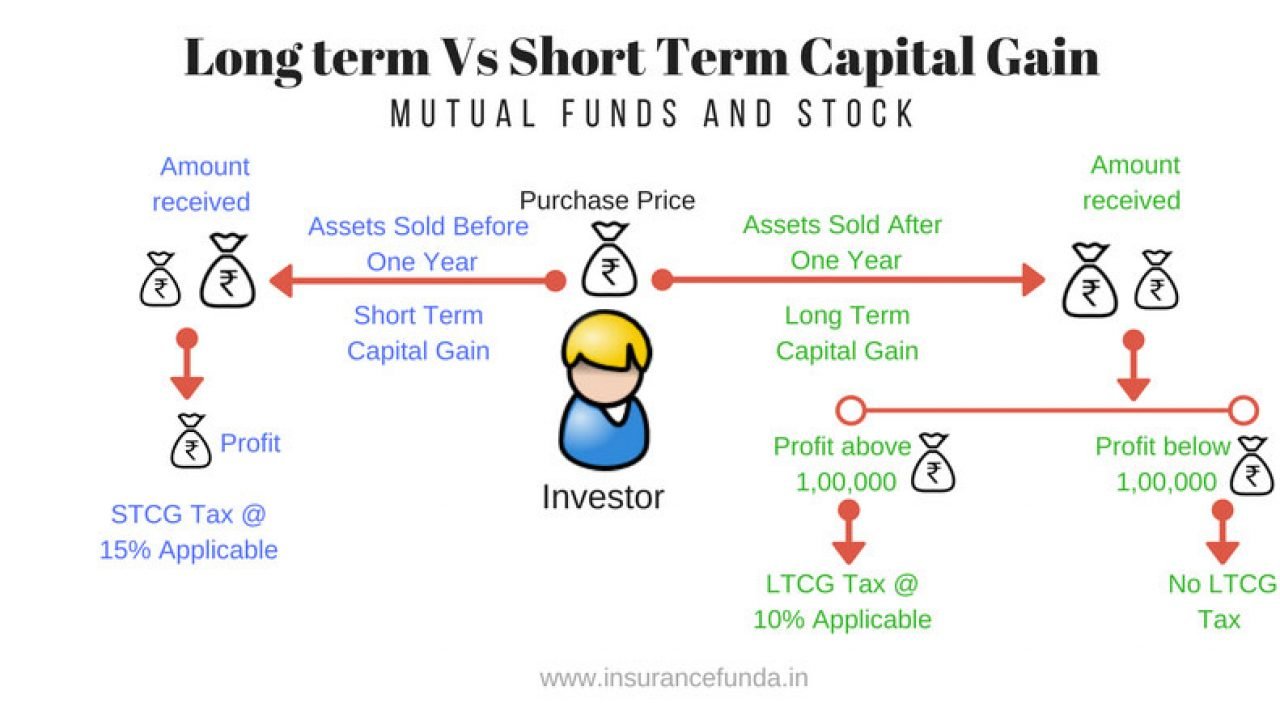

Short-term vs. Long-term Capital Gains

The duration for which you hold an investment before selling it plays a significant role in determining the applicable tax rate. Short-term capital gains apply to investments held for a year or less and are taxed at the same rate as your regular income, following the IRS’s tax brackets.

On the other hand, long-term capital gains come from investments held for over a year before being sold for a profit. These gains typically benefit from a lower tax rate. For the tax year 2024, the maximum long-term capital gains tax rate is 20%.

Assets Subject to Capital Gains Tax

The scope of capital gains tax extends beyond the stock market and encompasses a broad range of assets considered “capital assets.” Any investment with the potential to appreciate and generate profit falls under the purview of capital gains tax. This includes real estate, bonds, and mutual funds.

2024 Capital Gains Tax Rates

Determining the amount subject to capital gains tax involves considering the duration of asset ownership (short-term or long-term) and your income, dictated by your tax bracket.

For short-term gains, your tax liability aligns with the regular income tax brackets.

Long-term capital gains tax rates for the tax years 2023 and 2024 are 0%, 15%, or 20%. The rate you face depends on your income level, with higher incomes incurring higher tax rates. Specifically:

- 0% rate applies to unmarried individuals filing separately with a taxable income up to $47,025, married couples filing jointly up to $94,050, and heads of households up to $63,000.

- 15% rate applies to unmarried individuals with a taxable income between $47,025 and $518,900, married couples filing separately with income between $94,050 and $583,750, and heads of households with income between $63,000 and $551,350.

- 20% rate is applicable to individuals with taxable income above the 15% threshold in their respective categories.

Understanding these rates is vital for accurate tax planning, ensuring compliance with tax obligations, and optimizing your financial strategy.

Conclusion

In the intricate landscape of tax regulations, the capital gains tax stands as a pivotal consideration. Knowing how it applies to your investments, the duration of ownership, and the corresponding tax rates empowers you to make informed financial decisions. As tax laws can evolve, staying updated with the latest information ensures your approach to capital gains tax remains effective and aligned with your overall financial goals.

Travel to Europe

Coach rental in Europe

Travel agency Paris

DMC for Europe

DMC for Paris